Are you interested in gaining exposure to Bitcoin without the problem of dealing with your intricate personal cryptocurrency? Then Bitcoin Exchange-Traded Funds (ETFs) is probably the ideal answer for you. But how do you tune the health and performance of those ETFs? Look no further than SoSoValue’s bitcoin etf inflows tracker!

Understanding Bitcoin ETF Inflows

Bitcoin ETF inflows are usually the net amount of capital flowing into Bitcoin ETFs over a specific period. These inflows provide precious insights into investor sentiment, market inclinations, and the overall fitness of the cryptocurrency ETF landscape. By monitoring Bitcoin ETF inflows, traders can gauge the volume of interest in Bitcoin as a funding asset and make statistics-driven alternatives as a result.

Analyzing SoSo Value ETF Dashboard

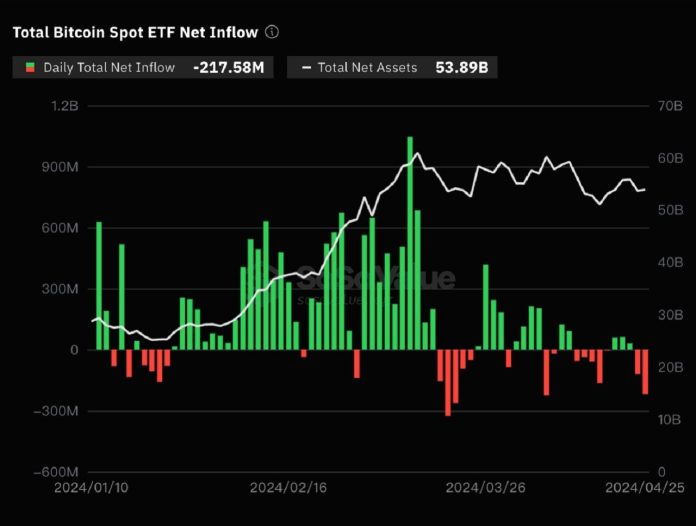

The SoSo Value ETF Dashboard serves as an effective instrument for buyers, providing real-time and historic facts on Bitcoin ETFs. With features like daily net influx, cumulative total net inflow, total value traded, and overall net assets, the dashboard offers a comprehensive view of the Bitcoin ETF market. Investors can leverage these statistics to assess the performance and liquidity of various ETFs, discover tendencies, and formulate investment techniques.

Key Metrics and Indicators

When monitoring Bitcoin ETF inflows, a lot of criterion standards and indicators come into play. Regular total net inflow indicates the net amount of principal flowing into or out of Bitcoin ETFs. Cumulative gross net inflow tracks the net inflows over a unique period, providing acuity into long-term trends. Total value bought and sold, and total net reserves give additional context, highlighting the liquidity and market capitalization of Bitcoin ETFs.

Why do you need to Track ETF Inflows?

Bitcoin ETF inflows, the net amount of money flowing into a Bitcoin ETF on a daily basis, offer valuable insights into investor sentiment. Positive inflows indicate investor’s trust in Bitcoin’s future, while negative inflows endorse a greater cautious approach. By tracking these inflows, you may:

Gauge Market Sentiment

A surge in inflows can signal growing interest in Bitcoin, potentially leading to price increases. Conversely, consistent outflows may indicate investor apprehension.

Identify Investment Opportunities

By knowing investor sentiment, you can make informed investment choices about Bitcoin ETFs or even directly into Bitcoin itself.

Track Market Liquidity

High trading volumes along with advantageous inflows advocate a clean and liquid Bitcoin ETF market.

Introducing SoSoValue’s Bitcoin ETF Inflow Tracker

SoSoValue’s Bitcoin ETF Inflows tracker enables you to stay informed. Their comprehensive platform gives a large number of features, which include:

- Real-Time Stats: Access up-to-date daily net inflows and outflows for a curated list of ten distinguished Bitcoin ETFs.

- Historical Data Analysis: Dive deeper with historic facts charts, permitting you to research developments and perceive patterns in Bitcoin ETF inflows.

- Comparative Analysis Tools: Evaluate the overall performance and liquidity of various Bitcoin ETFs side-by-side to find the ones that fit your investment dreams.

- ETF News & Updates: Stay informed about the latest developments in the Bitcoin ETF landscape with our dedicated news section.

- Spot ETF Schedule: Gain insights into upcoming Bitcoin ETF listings, regulatory decisions, and other crucial dates that might impact the market.

Conclusion

In conclusion, exploring Bitcoin ETF inflows gives precious insights into the dynamics of the cryptocurrency market. By leveraging the SoSo Value ETF Dashboard and reading key metrics, buyers can make knowledgeable decisions, navigate marketplace tendencies, and capitalize on opportunities efficiently. With complete expertise in Bitcoin ETF inflows, investors can embark on their investment journey with self-belief.